Keeping you home, where you belong.

Keeping you home, where you belong.

Keeping you home, where you belong.

Due to recent changes in the court rules allow us to teleconference and file your case without ever leaving your home

Welcome to The Massachusetts Loan Modification Help Center

The Massachusetts Loan Modification Center has only one core mission, and that is to provide mortgage modification help by favorably adjusting your interest rate, your principal balance, the length of your loan or by forgiveness of past due amounts, late fees and collection costs. While each person’s current mortgage and financial circumstances are different, you will enjoy the benefit in knowing that your no cost consultation will be with a licensed Massachusetts Loan Modification Lawyer who has a record of success in obtaining loan modifications. You will receive a complimentary analysis of your loan or loans, as well as advice on what options you may have available to reduce your monthly payments or otherwise assist you in obtaining a new payment arrangement with your lender.

WHAT IF MY LENDER STARTS FORECLOSURE PROCEEDINGS

IMPORTANT INFORMATION! Throughout this process, you may receive paperwork and legal documents from your lender, their attorneys, collections agencies, or other third parties. It is very important that you immediately forward any of these documents to your attorney for review and evaluation. You must also be aware, that even though you have filed a loan modification application, your lender can still proceed to foreclose on your home, and if you should receive court documents, certified letters, or anything from a sheriff, constable or law enforcement official, contact our office right away and get us the documents as quickly as possible so that your attorney may discuss with you what options you may have at that point in time, which may include, filing a bankruptcy petition to stop a foreclosure or filing for injunctive relief and lawsuit against your lender, if the facts dictate these courses of action. Any of these additional services will have to be discussed with your attorney and are not included with your loan modification application.

For more information on Foreclosure check out massachusettsforeclosurecenter.com

Attorney Richard S. Ravosa, Esquire

Richard S. Ravosa, Esquire, was one of only fifteen lawyers recognized in 2005 by Massachusetts Lawyers Weekly as a “rising star” for his achievements in representing clients with difficult legal obstacles to overcome, his business acumen, and entrepreneurship skills. Attorney Ravosa is admitted to the practice of law in Massachusetts and Connecticut and has an accomplished record as a bankruptcy lawyer, trial lawyer, negotiator, and strategist. Attorney Ravosa is a member of the Boston Bar Association, Massachusetts Bar Association, American Trial Lawyers Association, American Bankruptcy Institute, National Association of Consumer Bankruptcy Attorneys and a member of the Boston Bar Association's Bankruptcy Section and is chief legal counsel of the Massachusetts Bankruptcy Center.

Attorney Michelle Cote

Attorney Michelle L. Cote, heads the firm’s Worcester office. She is a graduate of the Massachusetts School of Law at Andover, where she won numerous awards of distinction for legal writing, legal advocacy, and litigation practice. Her practice is focused on all areas of personal injury law, including car accidents, animal attacks, slip and fall cases, catastrophic injuries, medical malpractice, products liability, premises liability and insurance litigation. Attorney Cote also oversees the firm’s Loan Modification and Mortgage Restructuring Department and Business Law Division. She is a cum laude graduate of Worcester State College and Assumption College in Worcester. Attorney Cote is a member of the American Bar Association, Massachusetts Bar Association and Worcester County Bar Association.

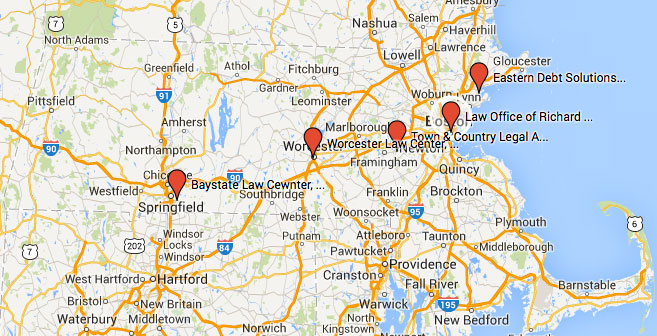

| BOSTON LAW OFFICE | ||

| Waterfront Lawyer’s Building 300 Commercial Street Boston, MA 02109 |

Phone: Fax: |

(617) 720-1101 (617) 720-1104 |

| NATICK LAW OFFICE | ||

| One South Avenue Natick, MA 01760 |

Phone: Fax: |

(508) 655-3013 (508) 205-0740 |

| SPRINGFIELD LAW OFFICE | ||

| 55 State Street, Suite 317, Springfield, MA , 01103 |

Phone: Fax: |

(413) 734-4147 (413) 304-2730 |

| WORCESTER LAW OFFICE | ||

| 40 Jackson Street, Suite 1020 Worcester, MA 01608 |

Phone: Fax: |

(508) 655-3013 (508) 205-0740 |

MASSACHUSETTS HOME FORECLOSURE AND LOAN MODIFICATION RESOURCES

Recent Results

TOPICS: Loan Modification Help | Government Help to Stop Foreclosure Modification | Loan Workout | Home Loans | Mortgage Help | Stop Foreclosure | Foreclosure Process | Loan Safe Solutions | Countrywide Home Loans | Commercial Loan Workout | Mortgage Loan Modifications | Home Loan Modification | Obama Loan Modification Plan | Loan Modification Program | Save House From Foreclosure | Foreclosure Prevention and Assistance | Mortgage Loan Modification Help | Modify your loan

This page may be considered “advertising” under Massachusetts Supreme Judicial Court. The information presented on this page in no way constitutes legal advice and does not establish an attorney client relationship, which can only be done after you and an attorney meet and agree on the terms of that relationship.